After a couple of years of intensive hiring in the tech and financial services industries, we have been witnessing over the last couple of months a complete U-turn, with giants such as Alphabet, Microsoft, Salesforce, Morgan Stanley or Goldman Sachs announcing rounds of layoffs. The almost simultaneous timing can be traced back to the recent deterioration in macroeconomic forecasts as much as to PR grounds – it is always easier to announce layoffs when you are not the only one in your industry to do so.

Terminating a collaboration is always painful, for the employer but first and foremost for the employee. The aim of this article is not to deny this pain but to cast an ‘economic theory’ light on the issue and explain why this outcome, although humanly terrible, is the result of a sequence of rational moves.

Indeed, banks and tech companies have evolved in similar environments:

- Unpredictable future activity level – the spike of today does not condition the activity level of tomorrow;

- A relatively shallow talent pool (bankers, developers etc.) due to the acute skillset required;

- High ‘opportunity cost’, i.e. the incremental revenues generated by an additional employee dwarfs the cost of the aforementioned employee – especially when this employee works 100+ hours per week. The fact that banks competed with perks and salary increases all over last year is probably one of the clearest pieces of evidence that the value brought by a junior banker is disproportionate compared to his/her cost;

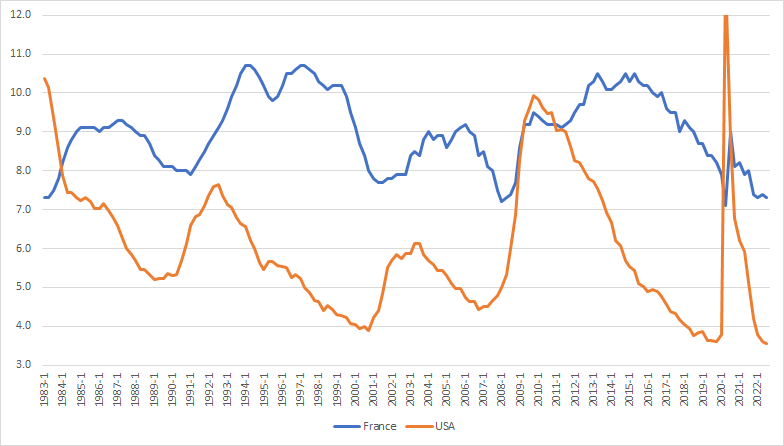

- In the US, where the vast majority of the headcount reductions have taken / will take place, limited cost to terminate an employee, both visible (e.g. notice period, severance package) and invisible (e.g. time spent in possible subsequent litigation action). P.S.: On a side note, this macroeconomic policy explains, to a large extent, why swings in unemployment rate are much more pronounced in the US (a rather ‘liberal’ country) than in France (where the ‘welfare State’ is much more prominent) for instance;

Sources : INSEE, US Bureau of Labor Statistics

- A slight delay between the moment a person signs his/her employment contract and the moment he/she is fully productive (he/she has to resign from his/her previous job, get onboarded into the new company etc.).

For all those reasons, banks and tech firms had a strong incentive to hire as much as possible, to keep feeding the corporate growth engine with ‘warm’ brains at all times. The cost of missing one brain was much greater than the cost of having one too many. Only Apple seems to have stayed clear of this frenzy (for now).

Furthermore, even if they are significant, the redundancy plans remain of a reasonable size compared to the recruitments made by these same companies since 2019. Before the axe fell, Alphabet and Microsoft had added more than 80’000 employees each to their payroll over the last 3 years. Net, they are still 70,000 up compared to pre-COVID. As a consequence, we can see the recent announcements as twofold: either Big Tech is still riding a major, although less so than originally thought, growth wave, or this round is only the first of a series.